MaxLend

About this app

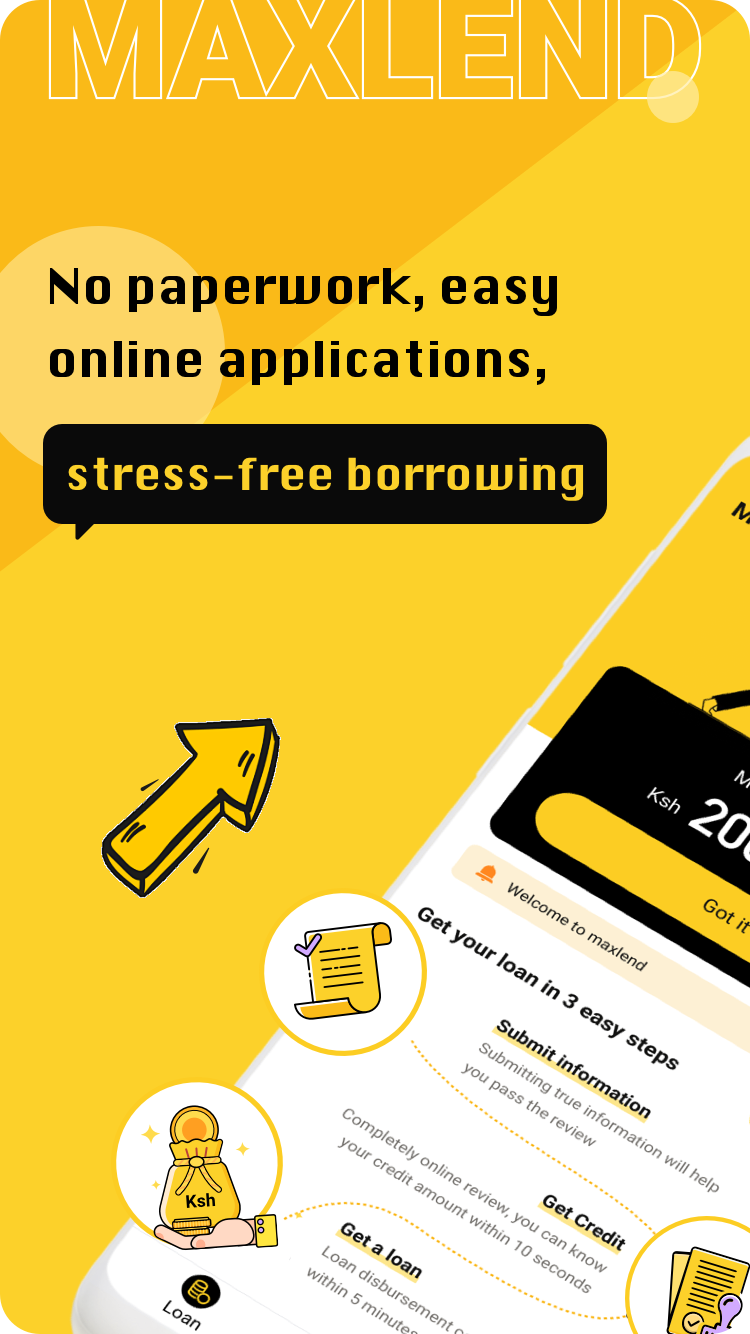

Advantages of MaxLend:

1. Quick solutions: Personal consumption loans, renovation loans, travel loans, etc.

2. Quick loan: The loan process is simple, the online credit investigation is fully

automated, and the account arrives

in 5 minutes.

3. Flexible amount: Easy loan for small amount, up to Ksh 80,000 for large amount (subject

to

approval)!

4. Ultra-low threshold: Complete online application, no mortgage loan.

5. Low interest: Maximum daily credit rate does not exceed 0.04%.

6. Information confidentiality: User information is strictly confidential and

reliable.

7. Convenient operation: Real-time query of loan progress, due date reminder, convenient

loan and repayment.

8. Find quick loans for small loans (money, mobile phone loans).

Requirements to use MaxLend:

1. Good credit history: MaxLend will check your credit history to assess the user's

payment capacity and credit risk.

Having a good credit history, such as timely payments, no history of delinquency, etc., can

increase the chances of

users applying for a loan.

2. Stable source of income: It is necessary to demonstrate that the user has a stable source

of income and the ability

to repay the loan on time.

3. Repayment capacity: MaxLend will assess the user's debt tolerance to ensure that the

user has sufficient income to

repay the loan on time.

4. Age requirement: Must be an Kenya citizen over 18 years old.

Introduction to MaxLend product:

1. High loan amount: up to Ksh 80,000 (subject to approval).

2. Quick loan approval: provides secure, reliable, and convenient loan services.

3. Long-term loans: minimum 91 days, maximum 365 days.

4. Transparent interest rate and flexible payment: the maximum annual loan interest rate is

15%, and the daily loan

interest rate does not exceed 0.04%. Multiple payment methods are accepted.

5. Data security: personal information is encrypted at all times, providing total

protection.

6. Loan range: minimum Ksh 5,000 ~ maximum Ksh 80,000

If you borrow Ksh 10,000 from MaxLend, the term is 120 days (4 months), the interest is

0.04% per day (the maximum

annual interest rate is 15%), no commission is charged except for interest, the following

fees will be paid:

Daily Interest = Ksh 10,000 x 0.04% = Ksh 4

Monthly Interest = Ksh 4x30 = Ksh 120

Monthly payment = Ksh 10,000 / 4 + Ksh 120 = Ksh 2,620

Loans due within 120 days

Your total interest = Ksh 4 x 120 days = Ksh 480

Your total repayment = Ksh 10,000 + Ksh 480 = Ksh 10,480

*These figures are for informational purposes only, and final interest rates may vary based

on the borrower's credit

assessment.

Requirements:

Be over 18 years old

Valid PAN card identification

Be the account holder of the bank account

On user information security:

MaxLend protects the information of all users. Without the user's permission, we commit

not to disclose their

information to anyone.

Contact us:

Email: [email protected]

Our business hours are Monday to Friday from 9:00 am to 6:00 pm.